J_Bus_Account_Financ_Perspect 2021, 2(3), 21; doi:10.35995/jbafp2030021

Business Model Themes and Product Market Strategies as Value Drivers in Omni-Channel Retail: A Set of Propositions

1

Uppsala University, Sweden

2

Marie Curie Research Fellow, Maynooth University; gueltekin.cakir@mu.ie

*

Corresponding author: ricardo.costacliment@im.uu.se

How to cite: Ricardo Costa Climent, Gültekin Cakir. Business Model Themes and Product Market Strategies as Value Drivers in Omni-Channel Retail: A Set of Propositions. J. Bus. Account. Financ. Perspect., 2020, 2(3): 21; doi:10.35995/jbafp2030021.

Received: 18 May 2020 / Accepted: 11 February 2021 / Published: 23 March 2021

Abstract

:We focus on the analysis of current research in Business Models in the context of e-business, resulting in relevant research gaps and a set of propositions. A bibliographic review has been conducted from which a theoretical framework has been developed. Once the gaps in the literature have been pointed out, a series of research proposals are presented. These should be tested based on data collected from real cases through analysis and interpretation. The applied lens of the theory is Amit and Zotts Business Model framework (2001) and Business Model Themes (BMT) “NICE” (novelty, lock-in, complementarity and efficiency) (2001). Analysis evolves around the explanation and feasibility of Business Model Themes for value creation and value capture in digital business models (current general research gap in the e-business domain). The results show that future directions should investigate different combinations of BMTs which represent research gaps (propositions 1 to 3). Other contexts which were not considered so far in this regard (non-digital business), also represent a research gap (proposition 4). Moreover, further synthesis of the literature resulted in a potential consideration of “product market strategies” (Amit and Zott, 2008) as a new theory to apply and test value creation and capturing in digital business (proposition 5 and 6), also from an evolutionary perspective. We ask how this combination affects the performance of firms who want to move on digital transformation with an omnichannel environment. It is essential in this study how these firms can create new value and how they can keep it. We try to explain how these value drivers could be work across time, even under varying environmental regimes. It would mean an advance in the existing academic framework around the reference literature on the business model. To be able to determine which combinations of BMT and Product Market Strategy (PMS) have not yet been tested would be advantageous for the firms. It could offer the appropriate information to the retail company with traditional BM towards digital BM. Moreover, it will be able to work successfully and to maintain constant along the time.

Keywords:

Omnichannel; business model; coevolution; business model themes; value creation1. Introduction

In the current business environment, many companies are attempting to move towards the adoption of a business model for digital retailing. Therefore, it is essential to identify the critical factors for success or failure, in terms of both outcome and governance strategy. Only then will it be possible to develop guidelines that companies can implement to create value and enjoy long-term success. The main objective of this paper is to present the academic findings in relation to the transformation of traditional business models into digital business models for European brick-and-mortar retailers. This study specifically focuses on omnichannel and value creation.

With the advent of technology-based shopping alternatives, retailers have begun to broaden their sales channels to include many new service processes. Altogether, this process has evolved into what is now known as omnichannel retailing. It is essential to clarify exactly what this means. The main objective of omnichannel retailing is for consumers to enjoy a seamless shopping experience, regardless of which channel they use (Rigby, 2011; Brynjolfsson et al., 2013; Bell et al., 2014). It is a truly integrated approach to the entire sales operation. It provides a perfect response to the consumer experience across all available purchase channels. Ultimately, this study aims to provide empirical data to help identify the key factors that a company should consider when moving from a traditional retail business model to a digital business model based on the omnichannel customer experience.

The transformation of a business towards an omnichannel model requires the adoption of new market strategies. For example, these businesses must incorporate digital technologies (such as mobile phone applications and augmented reality), new work procedures, new organisational competencies, roles, functions, structures and budgets, and new suppliers, vendors, technologies and other inputs. Finally, they must comply with various legal and institutional structures. In short, this transformation involves a profound review and restructuring of both the commercial strategy and the business model. Such changes entail a high cost for the organisation in terms of effort, time and resources. Therefore, it is valuable to offer companies the maximum possible insight into successful strategies that can speed up the process and lead to a higher rate of success from this transformation.

As already mentioned, this new model requires changes to the structure and organisation of the company. However, the company will also have to take into account its relationship with all the parties involved in the transactions that form a part of its activity, which means establishing a new business model.

In 2001, Amit and Zott developed a business model (BM) concept that signalled a turning point in the use of the Internet in new virtual markets and digital technologies. The business model is a structural template that describes the organisation of the transactions of a central company with its external components in the factor and product markets. It is central to value generation and, consequently, to a firm’s market value.

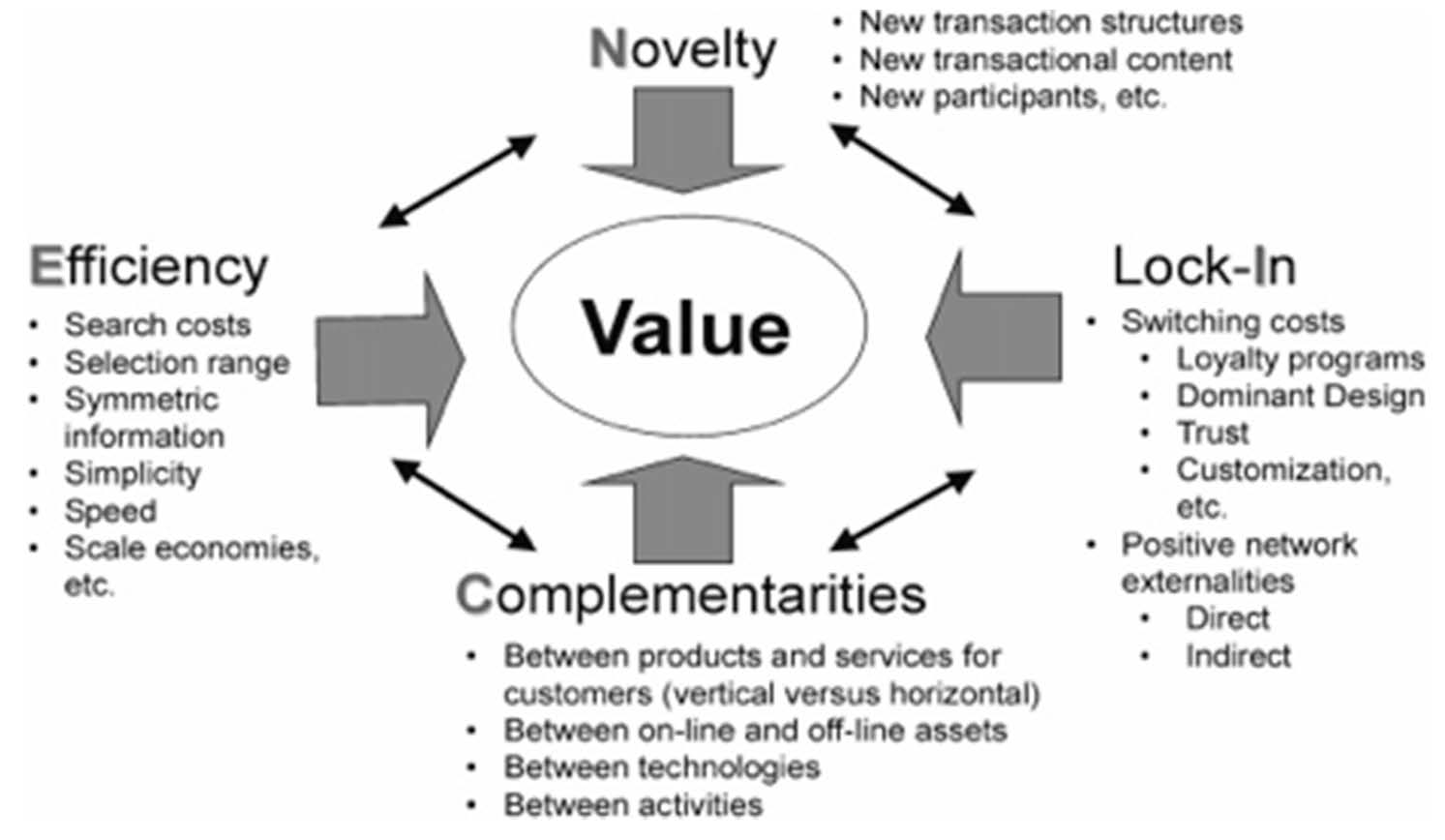

According to Amit and Zott (2001), value creation in a company occurs through the exploitation of business opportunities, as well as the design of content, structure and transaction management. This value creation consists of four main, interrelated factors that drive the value of e-businesses. These are the business model themes (BMTs), which correspond to the mnemonic ‘NICE’: novelty, lock-in, complementarity and efficiency. In their study, Amit and Zott (2001), point out the interrelationships between these four phenomena and clarify why they are necessary to explain the value creation of the business model.

Empirical studies have reaffirmed the effectiveness of the business model themes. Studies have also shown the relevance of certain combinations between some of the BMTs, as well as between the BMTs and the product market strategy (PMS). However, there is little empirical evidence for each individual BMT and for combinations of BMTs or for the effect of time on the transformation of BMTs.

Therefore, this paper presents a set of propositions aimed at answering our research question: How do business model themes (BMTs) influence company performance in the transformation of the traditional business model to omnichannel? The propositions specify new empirically unproven combinations of BMTs and the new, unproven combinations of these BMT and PMS.

After a brief explanation of the method, we provide the theoretical framework resulting from the literature review. The empirical gaps are also highlighted, and the research proposals are presented. Finally, the theoretical and practical relevance of this research is discussed. The paper ends by offering the conclusions of the study.

2. Literature Review and Theoretical Section

2.1. Business Model

Although decades have passed since the business model was first discussed (Bellman et al., 1957), Amit and Zott (2001) developed this concept in an innovative and revolutionary way in response to the use of digital technologies and the Internet and to the creation of new virtual markets.

The business model is a multi-stakeholder structural model (Teece, 2010; Foss and Saebi, 2017). Its system of activities stretches beyond the limits of the company, covering all its resources, activities and actors, all linked by transaction mechanisms (Amit and Zott, 2001; Zott and Amit, 2010). Actors such as customers, suppliers and partners are not involved independently but interact in pursuit of the same objective or need—namely, the creation and appropriation of value (Brandenburger and Stuart, 1996).

The business model is also a competitive advantage, and one that differs from the market position of the company’s products (Amit and Zott, 2008). Business models consider value creation on both the supply and demand sides, contrary to traditional theories, which consider value creation only on the supply side (Massa et al., 2017). It means this concept of Musiness Model includes all kinds of activities and resources, networks of actors and company transactions (Zott et al., 2011; Massa et al., 2017).

The business model concept has been the subject of research for over two decades (Ghaziani and Ventresca, 2005; Kulins et al., 2016). Business model theorisation is beginning to become part of the academic literature (Amit and Zott, 2001), possibly due to the confluence of two realities (Zott et al., 2011; Massa et al., 2017). The first relates to the changes in the global economy due to development and digital technologies, the globalisation of markets and production chains, and regulation agreements among markets. The second is the inability of orthodox theories to explain the surprising value creation of companies such as Apple (Parker et al., 2016).

The construction of the business model has suffered from a certain fragility and lack of agreement among those who define it (Ritter and Letti, 2018; Ricciardi et al., 2016; George and Bock, 2011). Despite the existence of different definitions of varying complexity, there seems to be some consensus that the business model of a company is the “architecture of the value creation, delivery, and capture mechanisms” (Teece, 2010, p. 172). Here, the term architecture refers to “the functional relations among those mechanisms and the underlying activities” (Foss and Saebi, 2017, p. 215).

Due to the limited theoretical basis of most definitions (Kulins et al., 2016), we use the definition provided by Amit and Zott (2001). Thus, the business model is defined as “the design of transaction content, structure, and governance so as to create value through the exploitation of business opportunities” (Amit and Zott, 2001, pp. 494–495). This definition was adopted to ensure the relationship of our findings with other studies, especially the work of Zott and Amit (2007). Amit and Zott developed a business model conceptualisation that broke new ground in reference to the use of the Internet and digital technologies. Their approach is based on the unification of previous theoretical bodies: the resource-based view (Wernerfelt, 1984; Barney, 1991), configuration theory (Miles and Snow, 1978, 1986), value chain analysis (Porter, 1985), transaction cost theory (Williamson, 1975), externality theory (Katz and Shapiro, 1985), strategic network theory (Doz and Hamel, 1998; Gulati et al., 2000), Schumpeterian innovation theory (Schumpeter, 1934) and contingency theory (Donaldson, 1987; Miller, 1992). They fused these bodies of theory in a coherent theoretical aggregate that allows the interpretation, explanation and prediction of the creation of economic value in (digital) business models.

Amit and Zott’s contribution to this research is significant for the following reasons:

- -

- Most existing business model definitions are not based on traditional theoretical bodies; they are typically theoretical. This means that they ignore many years of research on economic value creation;

- -

- The theoretical body of Amit and Zott’s business model has been empirically tested to some extent in both qualitative and quantitative studies. This testing supports the theoretical construction of the business model;

- -

- It outlines a definition of the business model in terms of content, structure and governance.

2.2. Business Model Themes (BMTs)

The three elements incorporated by Amit and Zott (2001) in their definition of the business model are transaction content, structure and governance. These elements can be understood as basic elements that are capable of describing the architecture of a business model (Zott and Amit, 2010). However, they do not explain how such an architecture should be designed to create and capture value.

In this context, Amit and Zott (2001) suggest four configurations or designs that drive value creation in business model design: complementarity, efficiency, novelty and lock-in (Amit and Zott, 2001, 2008; Zott and Amit, 2007; Kulins et al., 2016). BMTs, together with firm and industry-specific effects, condition firm performance (Rumelt, 1991; Hawawini et al., 2003; McGahan and Porter, 2002). The following figure (Figure 1) by Amit and Zott (2001) details a series of concepts that characterise and help to identify each of the BMTs.

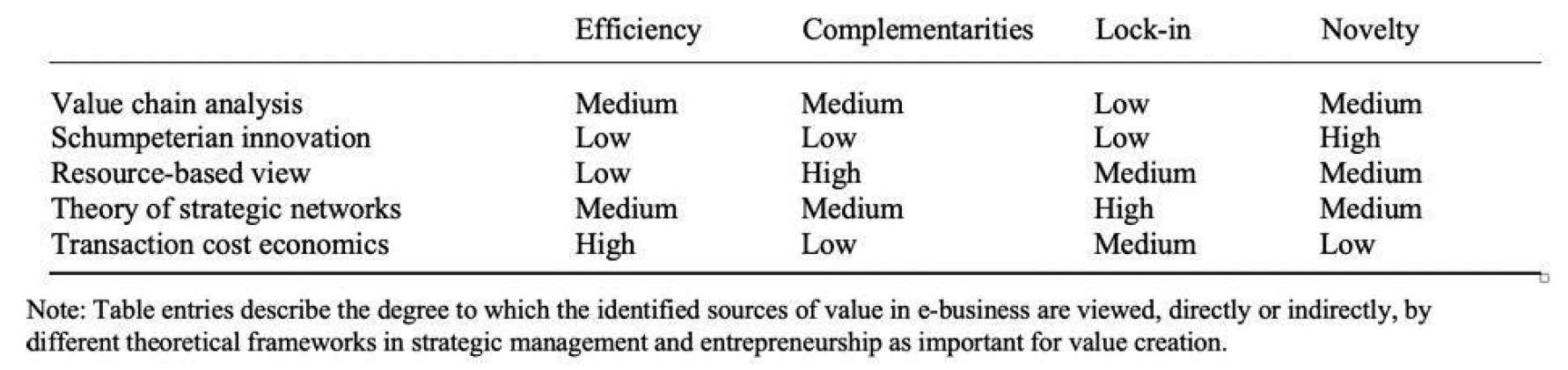

The business model incorporates the essence of previous theoretical insights (Amit and Zott, 2001): the resource-based view, value chain analysis, Schumpeterian innovation, strategic network theory and transaction cost economics. Amit and Zott (2001) establish these four dimensions of value creation based on their presence in these traditional theories. Figure 2 summarises how firmly the BMTs are anchored in these theories.

- Complementarity

The essence of designing business models for complementarities is the synchronisation of resources and capabilities (inputs) or products and services (outputs). Complementarities are present when the value of the whole exceeds the sum of the values of the parts (Zott and Amit, 2002, Milgrom and Roberts, 1995; Ennen and Richter, 2010). The resource-based view highlights the role of complementarities among strategic assets as a source of value creation (Amit and Schoemaker, 1993). Strategic network theory highlights the importance of complementarities among network participants (Gulati, 1999). Therefore, complementarities can be expected to increase the value of the firm by allowing income to grow.

- Efficiency

Efficiency is described by Zott and Amit (2002) as the reduction of transaction costs and the optimisation of a company’s resources, compared to its peers, by the agents involved in its system of activities. Efficiency includes the time that managers and staffs spend searching for customers and suppliers, communicating with their equivalents in other firms, travel expenses, physical space for assemblies and processing of paper documents, as well as production expenses and inventory management (Lucking-Reiley and Spulber, 2001). Transaction costs can also be borne by customers, for example, in the form of search costs. In addition to these direct costs of economic transactions, there are indirect costs, such as the costs of adverse selection, moral hazard and retention (Williamson, 1975). Therefore, efficiency creates value directly for clients and can serve as an incentive.

- Lock-in

The design of a business model to increase lock-in is made possible by providing incentives for customers, suppliers and partners to engage in repeat transactions and by creating disincentives to switch to rivals (Zott and Amit, 2002). Lock-in can manifest itself through sunk costs (Parayre, 1995). It can also manifest itself through exchange costs, which are anchored in the Williamson (1975) transaction costs framework. Similarly, it can manifest itself as network externalities (Boshuijzen-van Burken and Haftor, 2017), which have their roots in strategic network theory (Katz and Shapiro, 1985; Shapiro and Varian, 1999) and which refer to situations where the value of a product or service to a user depends not only on the product itself but of the number of users consuming that product or service (Fuentelsaz et al., 2002). Amit and Zott (2001) suggest that under the RBV, a company’s strategic assets, such as its brand name and trust between buyers and sellers, contribute to lock-in.

- Novelty

The essence of designing novel business models is to conceive and adopt new ways of conducting economic exchanges (Amit and Zott, 2001; Zott and Amit, 2007). This can be achieved, for example, by uniting previously unconnected parties, linking participants of transactions in new ways or designing new transaction mechanisms (Zott and Amit, 2002). The unique characteristics of virtual markets (i.e., the removal of geographical and physical constraints, the potential reversal of information flow from customers to suppliers, and other novel techniques of bundling and channelling information) make the possibilities for innovation seem endless (Amit and Zott, 2001).

2.3. Interdependence and Interactions of Business Model Themes (BMTs)

Understanding the interconnections between the design elements of the business model is fundamental to view the role of the business model not only as a way of generating value but also as a way of retaining value that has already been created. A good example is provided by examining the lock-in dimension (Amit and Zott, 2001). It is the only BMT that is not necessarily beneficial to customers because it is based on imposing switching costs on them. Therefore, it may have to be combined with other dimensions to constitute a significant value driver. Thus, Zott and Amit (2007) found no statistically significant impact when testing lock-in business model designs. Therefore, research on combinations with other design themes should be conducted because such research could provide interesting findings (Kulins et al., 2016).

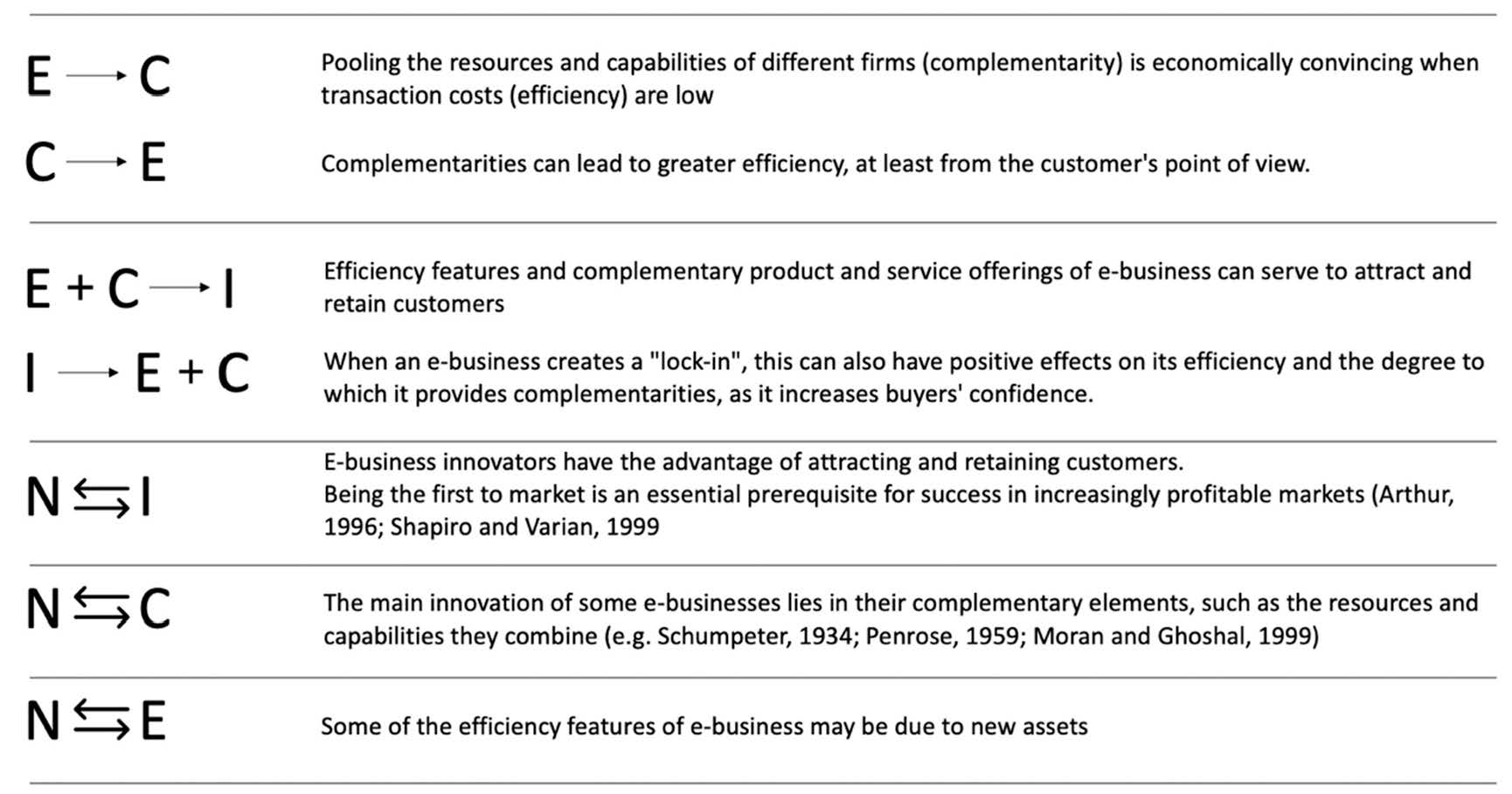

In their early studies, where they propose the importance of BMTs, Amit and Zott (2001) refer to the need for interdependence of sources of value creation and describe their role in e-commerce. The following figure (Figure 3) summarises the relationships that the authors describe between the BMTs in determining variation in company performance.

Subsequent studies have tried empirically to demonstrate the real consequences of the combination of different BMTs. Kulins et al. (2016) tested the effect of different combinations, such as novelty with lock-in and efficiency with complementarity and lock-in. The study of the interaction between novelty and efficiency has led different researchers to different conclusions. This combination has been observed by Zott and Amit (2007) to have slightly negative effects, whereas Kulins et al. (2016) concluded a significant interaction in support of company performance.

Other factors are involved in the effect of BMTs on the success or failure of a company. These include environmental factors, contextual factors, different market strategies and evolutionary factors. One example is the study of the interaction between business models focused on novelty or efficiency and an environmental factor such as a company’s degree of access to the external resources it needs (or munificence).

The product market strategy (PMS) is the way a company decides to position itself with respect to its competitors in its target market areas. It refers to decisions regarding price, quality and timing (Geroski, 1997; Porter, 1985), which drive customer demand. The two fundamental strategic choices are therefore (1) product market positioning, cost leadership, and product or service differentiation (Porter, 1985); and (2) when to enter the market (Montgomery and Lieberman, 1988).

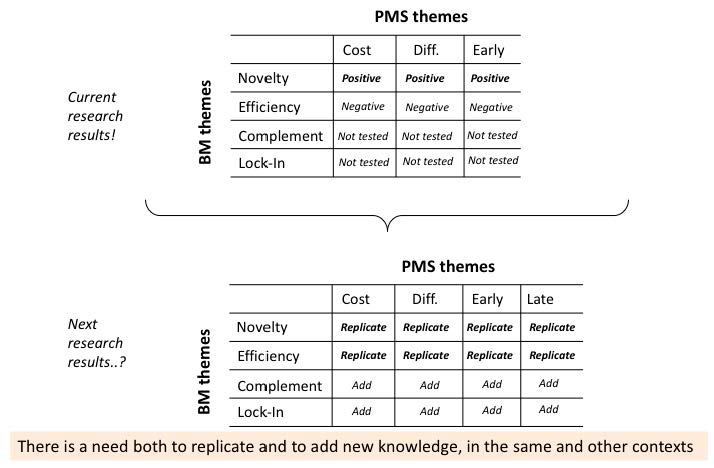

Some interactions between BMTs and PMS focused on testing their effect on company performance have been confirmed empirically. Examples include business models focused on novelty, along with differentiation, cost leadership and PMS based on early market entry (Amit and Zott, 2008).

2.4. Omnichannel

According to Beck and Rygl (2015) and Verhoef et al. (2015), omnichannel retailing is defined as: The sale of goods or services through all extended channels, which have been entirely linked to each other from the customer’s perspective, allowing full interaction between all channels and/or from the retailer’s perspective, establishing total control of channel integration.

Constant and rapid technological development has led in recent years to the transition from the traditional retail model of “brick and mortar” to a digital retail model. In doing so, the online and physical stores of modern retailers are integrated into a seamless shopping experience on digital and physical platforms (Piotrowicz and Cuthbertson, 2014; Ovezmyradov and Kurata, 2017). Omnichannel’s retailing is a relatively recent phenomenon that has been transforming the retail landscape, and which has not yet been solidly established among retailers due to its complexity and lack of understanding, and the lack of research and empirical experience in this regard.

Omnichannel retailing is differs from multichannel retail in terms of customer participation and retailer control. While omnichannel retailing derive synergies from the integration of the entire channel through the rationalisation of multichannel interactions with customers, multichannel retail focuses on the importance of the presence of retailers through various channels (Li et al., 2018).

The goal of omnichannel is to coordinate fragmented service processes and technologies across multiple channels to deliver a consistent and integrated customer experience. In an omnichannel environment, a focal enterprise designs its transaction content, structure and governance to create and retain value by exploiting business opportunities (Amit and Zott, 2001). This design requires a basic functional architecture (Foss and Saebi, 2017) to boost company performance. The study of BMTs is fundamental for the effectiveness of the transformation towards an omnichannel model because these value creation configurations are implicit in the very definition of omnichannel. Omnichannel involves novelty in services, technology, transaction mechanisms and relationships between actors; efficiency in the management of resources in a predominantly digital environment; complementarity between channels, products or services, and transactions to offer actors a more valuable experience than with a single channel; and actions focused on lock-in to maintain the company’s position with respect to competitors in a digital commercial network that is constantly changing and innovating.

3. Methodology

First, a bibliographic review was conducted to establish a theoretical framework. Through a narrative review of the literature, we present a citation analysis. We started with three core articles by Amit and Zott. In the first, the innovative notion of the business model is developed (Amit and Zott, 2001). In the second, some of the BMTs are empirically tested (Zott and Amit, 2007). In the third, some combinations of BMTs and PMS are tested (Amit and Zott, 2008).

From here, we identified articles that refer to or cite any of these three articles. We only considered articles that are related to the study of the business model, the effects of BMTs on company performance, and the process of transformation and evolution. From all the reviewed literature, a selection of articles was made. We analysed these articles, selecting those that are relevant to our research and to obtaining empirical results. The literature revealed theoretical gaps with an empirical basis in relation to the aims of our research. This will be specified in the Results section.

Once the gaps in the literature have been stated, a series of research proposals are presented. These should be tested based on data collected from real cases through analysis and interpretation.

4. Results

As a result of the literature review to detect the empirical studies in the literature on our research question, the following section first establishes justifies findings in the literature review which justify our research through the identification of the theoretical gaps.

4.1. Justification of the Study: Theoretical Gaps

Taking a broader view of organisations that transcends traditional business boundaries has been shown to be valuable in understanding wealth creation and performance. A study from this perspective can thus inspire new research on the relationship between company strategy, structure and boundaries. Probing into this area, we identified specific research gaps that can serve as a starting point and guide towards our main goal of advancing the strategic literature based on Amit and Zott’s business model theory. Such an approach reveals the best practices and guidelines for a successful transformation process to the digital environment, as well as the creation and retention of value for the company. Some of the theoretical gaps are summarised below.

In their early work, Amit and Zott (2001) developed the notion of the business model and its sources of value creation. This initial development was based on a qualitative and exploratory study. Subsequent endeavours have empirically attempted to test the effects of BMTs on variation in company performance. Independently, we have found empirical confirmation of the model for the themes of novelty (Zott and Amit, 2007; Wei et al., 2014; Brettel et al., 2012) and efficiency (Zott and Amit, 2007; Brettel et al., 2012). However, performance improvements derived from complementarity or lock-in have not been empirically confirmed, except in isolated case studies (Parker et al., 2016). This is the first theoretical gap.

Despite the interdependence of the theoretically explained BMTs and the effects of their interactions, only some of the possible combinations of BMTs have been tested. Examples of this testing are given by Kulins et al. (2016) and Zott and Amit (2007), in the case of the combination of efficiency and novelty, and by Kulins et al. (2016), in the case of the combination of novelty and lock-in and of complementarity, lock-in and efficiency. Accordingly, a second gap is the empirical study of untested BMT combinations.

Amit and Zott (2008) tested several BMTs together with PMS (differentiation, cost leadership or market entry) to link the notion of BMT to the traditional knowledge of competitive strategy. The cited study shows that, while a PMS and BMTs can act on their own as a source of economic value creation, the combination of BMTs and PMS can also act on their own as another source of economic value creation. However, not all combinations of PMS and BMTs have been tested to date. This is the third gap.

In recent times, research has examined the evolution of the business model, but considering only its internal elements such as products, activities or actors (Demil and Lecocq, 2010; Foss and Saebi, 2017). However, there is scant reference to the evolution and transformation of BMTs in terms of their effect on performance. The existing research on the variability of BMTs has been conducted from a static perspective by studying cross-sectional data from public companies. However, we know that business model configurations are transformed over time, so this dominant study approach does not consider these evolutionary and temporal dynamics (Nelson et al., 2018). For a complete picture of the role of BMTs in the dynamics of the company instead of just a static view at a given moment, the effectiveness of specific combinations of theories must be studied through, for example, panel data analysis. This approach would combine the longitudinal dimension with the cross-sectional dimension. It is therefore an area for further research, resulting in the fourth theoretical gap.

4.2. Business Model Theme (BMT) Proposals: BMTs, Combinations of BMTs and Context

As noted above, some, but not all, of the four BMTs have been tested quantitatively (Zott and Amit, 2007). Other themes and combinations of themes still have to be tested in other contexts. This is a key theoretical gap.

4.2.1. “NICE” Business Model Themes (BMTs): Novelty, Lock-In, Complementarity and Efficiency Tested Empirically

Regarding the tested BMTs (novelty and effectiveness), Zott and Amit (2007) concluded the following after an empirical study based on the respective hypotheses.

● Novelty

Independently, we have found empirical confirmation of the model centred on the theme of novelty (Zott and Amit, 2007; Wei et al., 2014; Brettel et al., 2012). In response to the statement that greater novelty in the design of the business model of an entrepreneurial company means higher performance, Zott and Amit (2007) concluded from their results that the design of innovative business models was indeed associated with higher performance. However, when resources are scarce, capital markets may be less receptive to new public offerings by companies whose value proposition is focused on new business models. During a period of scarce resources, entrepreneurial companies obtain better results if the design of their business model—and hence the value proposition for customers, partners and suppliers—includes efficiency improvements that reduce transaction costs, simplify transactions and streamline processes.

Within the framework of business model innovation, defined by Foss and Saebi (2017), novelty is a specific dimension and has a multiplying effect. This is because complex business model innovations, which are often proposed by emerging companies, affect the business model as a whole and have the potential to disrupt established industries (Foss and Saebi, 2018).

The above literature reports that business model innovation can be conducted for many reasons, including cost reduction, process optimisation, new product introduction, access to new markets and, of course, improved financial performance. However, there is little academic evidence of how business model innovation improves competitive advantage, profitability, innovation capacity and other aspects of organisational performance. Although it deviates considerably from the objective of this study, the need for empirical development of business model innovation in this regard is acknowledged so that it can become a fruitful line of research.

● Efficiency

Regarding the relationship between company performance and the design of an efficiency-based business model (Zott and Amit, 2007; Brettel et al., 2012), Zott and Amit (2007) observed that during a period of abundant resources, the design of efficiency-focused business models does not contribute to significant differentiation among entrepreneurial firms. However, in times of low resources, capital markets may be more receptive to new public offerings from firms that promise lower transaction costs.

● Complementarity

Foss and Saebi (2018) allude to complementarity as a key aspect of the business model and business model innovation. The notion of complementarity, which is closely related to traditional notions in research on the management of interdependence and synergies, is supported by a great deal of theoretical and empirical work (Brynjolfsson and Milgrom, 2012) that business model and business model innovation research can draw upon. Furthermore, the emphasis on complementarity is linked to “complex systems” (Simon, 1962, 1973).

Zott and Amit (2002) found empirical evidence of how to assess the impact of complementary design attributes on the bargaining power of the central company with its associated companies and customers. This analysis of complementary business model design took into account the resources, capabilities, products and services made available by other firms, and even by customers. The conclusion was that, on average, firms do not receive advantages in terms of higher market value and may even be at a disadvantage (Zott and Amit, 2002). This study focuses on arguments based on the theory of company negotiation with partners and competitors to link BMTs with the performance of the reference company.

Moreover, in the context of business model innovation, Foss and Saebi (2018) showed that its scope involves complementarities. Therefore, if part of a business model can be innovated in a “modular” way, it is because the complementarities with other parties are not so strong, although there can of course be strong complementarities within each individual “module”. This evidence shows the important role of complementarities within the design of the business model.

Proposal 1:

Complementarity: The greater the complementarity focused on the design of a company’s business model, the greater the performance of the company.

● Lock-in

Lock-in relies heavily on improving loyalty through incentives for customers and partners to engage in repeat transactions and on creating disincentives for them to move to competitors. Due to these exchange costs (it is the only “NICE” dimension that is not necessarily beneficial to customers), it may have to be combined with other dimensions to constitute significant value (Amit and Zott, 2001). We believe that a lock-in strategy could work if it is focused on achieving loyalty through retention incentives, building customer and company trust, brand strength, and more.

Proposal 2:

Lock-in: The design of a business model focused on customer retention through strategies that do not involve penalties for changing or direct costs to customers will mean higher performance.

4.2.2. Combinations of Business Model Themes (BMTs) Tested Empirically

In the context of the implicit interconnection between the BMTs proposed by Amit and Zott (2001), empirical results confirm the effectiveness of such an interconnection for only some of the possible combinations. Notable studies include those by Zott and Amit (2007) and Kulins et al. (2016). The qualitative comparative analysis (QCA) procedure used by Kulins et al. (2016) revealed three combinations of design themes that explained the high market value of the companies in the study sample. Unlike Zott and Amit (2007), who found no empirical evidence that lock-in and complementarities are related to performance, Kulins et al. (2016) observed each of the four design themes in at least one element of the solution: novelty and efficiency on the one hand and the combination of efficiency, complementarities and lock-in on the other. Thus, the authors demonstrated the relationship between the characteristics of design and its involvement in market value.

● Novelty + efficiency

Regarding the interaction between the design and performance of business models focused on novelty and efficiency, Zott and Amit (2007) worked from the premise that the more focused the novelty and efficiency is in the design of the business model, the higher the performance of the entrepreneurial company will be. According to their results (Zott and Amit, 2007), the effect of the positive interaction between these BMTs did not receive empirical support because none of the regressions had significant results in this regard. According to the authors, there may be “diseconomies of scope” because emphasising both efficiency and novelty in the design of a business model can be costly and can adversely affect performance. In this regard, the analysis provides preliminary, albeit statistically weak, support.

As for the study of the combination of novelty and efficiency conducted by Kulins et al. (2016), the conclusions are mixed. While they support the conclusions of Zott and Amit (2007) regarding the relationship between novelty and efficiency and high market value, they contradict the diseconomies of scope of Zott and Amit (2007) for the two dimensions when included together in a business model. According to Kulins et al. (2016), innovation in business models is a driver of success when connected to other value creators such as efficiency, which, by reducing transaction costs, creates value directly for customers and can serve as an incentive. Although there may be some difficulties in applying these two design themes in parallel (Zott and Amit, 2007), their successful use appears to create complementarities that subsequently increase the chances of achieving high market value (Kulins et al., 2016). This conclusion is consistent with Zott and Amit’s (2002) predictions about the influence of novelty on other design themes.

● Novelty + Lock-in

According to Kulins et al. (2016), a company that focuses on creating its business model through lock-in has a better chance of success when it introduces a completely new business model, which, by its very nature, offers a unique value proposition to its customers. Companies could approach this lock-in strategy in a more traditional way, such as positive network effects, trust, the need for initial investments for stakeholders or direct incentives such as loyalty programmes (Amit and Zott, 2001; Zott and Amit, 2002, 2007). However, as reported by Zott and Amit (2002), customers’ (or partners’) perceptions of the existence of a lock-in, ex-ante, is quite negative, so the lock-in functions as a barrier rather than a driver of value creation and capture (Kulins et al., 2016).

● Efficiency + Complementarity + Lock-in

To continue creating and capturing value by designing business models without placing a special emphasis on novelty, all the remaining design elements of the business model should be considered (Kulins et al., 2016). The novelty of a business model depends on whether or not others are innovative. However, a company’s ability to efficiently manufacture a product does not diminish with the improvement of competitors’ production capacity. Moreover, being the only one to offer a product requires a massive effort involving patents to exclude others from the market. Therefore, this consideration of combining the other three BMTs seems like it might potentially be easier to defend over time. Thus, Kulins et al. (2016) concluded that, although novelty is present in most configurations, it does not seem to be the lever that determines success in all cases.

Proposal 3:

The proposal is to continue the study of the impact of the remaining BMT combinations on company performance, especially on the creation and retention of value in the organisation.

4.3. Combinations of Business Model Themes (BMTs) and Product Market Strategy (PMS) Tested Empirically

As mentioned earlier, the combination of BMTs and PMS can also act on its own as another source of economic value creation (Amit and Zott, 2008). However, as discussed at length, not all combinations of PMS and BMTs have been tested. Therefore, several new combinations require thorough research to support such claims.

Based on the conclusions of the study by Amit and Zott (2008), we assume that a company’s strategy and business model are different constructs that affect the company’s ability to generate market value and that the different types of PMS are complementary to the business model. Companies looking for market strategies for similar products can do so with very different business models and can thus increase their value with respect to competitors. Therefore, a business model can affect a company’s performance in the same way that the company’s PMS does.

Amit and Zott (2008) evaluated the combination of two of the business model designs (novelty and efficiency) with the PMS (cost leadership, differentiation and market entry). They concluded that positive interactions are found in the case of novelty and suggested that these concepts are complementary rather than substitutive. In the case of efficiency, the study did not provide support for a positive interaction and did not reveal any complementarity with a differentiation strategy or with the timing of market entry.

The figure below (Figure 4) summarises the proven combinations of the BMTs and PMS, as well as their results. The figure also shows interactions that have not been tested and the need to replicate and add new knowledge about BMT and PMS combinations in different contexts and at different times. This matter is discussed later on in this paper.

Proposal 4:

The proposal is to further investigate the relationship between research model design and conventional PMS, especially in regard to the dimensions of value creation based on complementarities and linkages.

4.4. Evolution of Business Model Themes (BMTs) and Product Market Strategy (PMS) Tested Empirically

Sohl et al. (2017) concluded that different types of business models can initially determine performance heterogeneity and that the effect of the business model varies with the company’s operational experience (resource and capacity development). Even if a BMT itself and the combinations of BMTs and PMS are tested statically in companies, these forms evolve. Thus far, there has been little research on the time-dependent dynamics of evolution, which is an attractive third area of research.

References are found in the article by Kulins et al. (2016). Their study leaves room for the construction of theories about the evolution of a business model within a central company and its adaptation to different influences over time. Those authors propose as an essential and promising additional research topic to address the question of whether the full range of theoretically possible configurations is available to all companies in all sectors at all times.

Time must pass for organisations to adapt to change. This idea was proposed by Foss and Saebi (2018) in relation to the role of external actors (Ferreira et al., 2013), changes in the competitive environment (De Reuver et al., 2009), new information and communication technologies or ICTs (Pateli and Giaglis, 2005; Sabatier et al., 2012; Wirtz et al., 2010), and dynamic capabilities (Achtenhagen et al., 2013) to bring about change in the business model. According to Foss and Saebi (2018), the link between environmental conditions and organisational response has been studied in several streams of strategic and organisational literature.

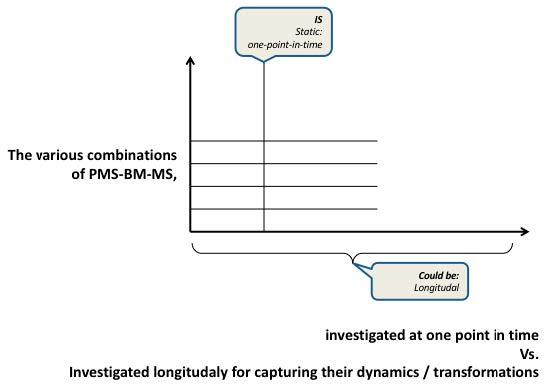

The combinations of BMTs and PMS have been investigated at a specific, static time (Figure 5). The proposal is for them to be investigated longitudinally to capture their dynamics and transformations.

Proposal 5:

The greater the adaptation of the company to different influences over time, the more effective the specific combinations of BMTs will be and hence the greater the positive impact will be on its performance.

- 5a: PMS-Cost + BMT-Complement ➔ High Performance;

- 5b: PMS-Cost + BMT-Lock-In ➔ High Performance;

- 5a: PMS-Diff + BMT-Complement ➔ High Performance;

- 5b: PMS-Diff + BMT-Lock-In ➔ High Performance;

- 5a: PMS-Early + BMT-Complement ➔ High Performance;

- 5b: PMS-Early + BMT-Lock-In ➔ High Performance;

- 5a: PMS-Late + BMT-Complement ➔ High Performance;

- 5b: PMS-Late + BMT-Lock-In ➔ High Performance.

5. Discussion

The concept of the business model arises from the inability of traditional economic theories to explain the creation of unprecedented value by certain companies since the beginning of the 21st century (Parker et al., 2016). The business model is an architecture for creating and retaining value (Teece, 2010). It does so through a system of activities linked together by transaction mechanisms that go beyond the limits, and in which all the actors involved have the common objective of creating value (Amit and Zott, 2001; Foss and Saebi, 2017; Writz et al., 2016). The business model is designed to create value by focusing on one or several of the “NICE” business model configurations or themes (BMTs): novelty, efficiency, complementarity and lock-in (Amit and Zott, 2001; Zott and Amit, 2007).

Empirical research has been conducted on the effects on company performance of certain BMTs, such as novelty (Zott and Amit, 2007; Wei et al., 2014; Brettel et al., 2012) and efficiency (Zott and Amit, 2007; Brettel et al., 2012). Some combinations of themes have also been examined, such as the combination of efficiency and novelty (Kulins et al., 2016; Zott and Amit, 2007), novelty and lock-in, and complementarity, lock-in and efficiency (Kulins et al., 2016). Exploring the effectiveness of BMTs in a more diverse set of industries and testing the theory in different circumstances is considered positive for professionals willing to create value through changes in the design of business models. It has been empirically shown through the study of certain interactions (Amit and Zott, 2008) that the combination of BMTs and PMS can also act by itself as another source of economic value creation. Therefore, it is crucial to conduct empirical studies of the combinations that have not been tested to date.

Although research has recently taken into account the evolution and transformation of the elements of the business model, such as products, activities and actors (Demil and Lecocq, 2010; Foss and Saebi, 2017), there is little reference to the evolution of BMTs in terms of their effectiveness on company performance. There is an inevitable evolution resulting in the need to identify the influence of time as a variable in the life of a company and the effectiveness of specific combinations of BMTs. This approach is particularly necessary in a world as ever-changing as ours, especially in all that relates to technology and information systems.

This bibliographic review aims to advance the strategic literature on business model. It does so by studying the “NICE” BMTs as key elements for companies when designing their business models in the highly specific circumstances of transformation towards an omnichannel model. The proposed conceptual framework reflects in-depth examination of the potential for value creation integrated into the models and theories that have been developed up to now. Moreover, in certain underdeveloped areas, it highlights the need for further empirical research on the effectiveness of the phenomena that characterise the business model design.

This proposal is relevant to practice because many companies are trying to move towards the adoption of a business model for digital retailing and full channel integration. Some companies succeed, while others fail. Therefore, it is essential to identify the critical success or failure factors to develop an empirical basis for tried and tested strategies that companies can put into practice. What untested combinations of BMTs (or BMTs with PMS) can work in an omnichannel environment? How do these combinations work in an evolving context as ever-changing as the omnichannel environment to give the right information to retailers with a traditional BM towards digitalisation for success? Theoretically, this study may also be relevant. This model is an attempt to advance, expand and contribute to the theoretical foundations outlined earlier in relation to the study of a governance strategy to identify best practices and guidelines for a successful process of transformation and value creation by the company.

6. Limitations

The main limitation of this research is that, although we know that various combinations of BMTs generate value and profitability in companies as well as the PMEs and the combination of both drivers, we also know that there are other factors that can be key in the transformation of a traditional business model to another on Omnichannel, and this analysis does not allow us to find them—for instance, its evolution over time.

7. Conclusions and Implications

This bibliographic study confirms the premise upon which this research is based—namely, the need for more substantive empirical evidence of the keys to successful value creation by business models in a highly interconnected world, made possible by advances in information technology. Following the literature review, specific research gaps were identified. These gaps can serve as a starting point and guide towards our main objective of advancing the strategic literature based on Amit and Zott’s (2001) business model theory. It shows us the best practices and guidelines for a successful transformation process towards the digital environment, as well as the creation and retention of value for the company. We advocate the application of a configurational perspective to business model research as an effective way of gaining a better understanding of the complex interrelationships underlying business models (Amit and Zott, 2001; Chesbrough and Rosenbloom, 2002; Morris et al., 2005) through the value creation configurations of BMTs (Amit and Zott, 2001).

Acknowledgments

This research is a part of the European Training Network project PERFORM that has received funding from the European Union’s Horizon 2020 research and innovation programme under the Marie Sklodowska-Curie grant agreement No 765395. This research reflects only the authors’ view; the European Commission is not responsible for any use that may be made of the information it contains.

References

- Achtenhagen, L.; Melin, L.; Naldi, L. Dynamics of Business Models—Strategizing, Critical Capabilities and Activities for Sustained Value Creation. Long Range Planning 2013, 46(6), 427–442. [Google Scholar] [CrossRef]

- Amit, R.; Schoemaker, P. Strategic Assets and Organizational Rent. Strategic Management Journal 1993, 14, 33–46. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Value creation in e-business. Strategic Management Journal 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. The fit between product market strategy and business model: Implications for firm performance. Strategic Management Journal 2008, 29, 1–26. [Google Scholar]

- Barney, J. B. Firm resources and sustained competitive advantage. Journal of Management 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Beck, N.; Rygl, D. Categorization of multiple channel retailing in Multi-, Cross-, and Omni-Channel Retailing for retailers and retailing. Journal of Retailing and Consumer Services 2015, 27, 170–178. [Google Scholar] [CrossRef]

- Bell, D. R.; Gallino, S.; Moreno, A. How to Win in an Omnichannel World. MIT Sloan Management Review 2014, 56(1), 45–53. [Google Scholar]

- Bellman, R.; Clark, C. E.; Malcom, D. G.; Craft, J. C. On the Construction of a MultiStage, Multi-Person Business Game. Operations Research 1957, 5(4), 469–503. [Google Scholar] [CrossRef]

- Boshuijzen-van Burken, C.; Haftor, D. An Assessment of the Uber App’s Normative Practice. Philosophia Reformata 2017, 82(2), 192–215. [Google Scholar] [CrossRef]

- Brandenburger, A. M.; Stuart, H. Value-based business strategy. Journal of Economics & Management Strategy 1996, 5(1), 5–24. [Google Scholar]

- Brettel, M.; Strese, S.; Flatten, T. C. Improving the performance of business models with relationship marketing efforts—An entrepreneurial perspective. European Management Journal 2012, 30, 85–98. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hu, J. Y.; Rahman, M. S. Competing in the Age of Omnichannel Retailing. MIT Sloan Management Review 2013, 54(4), 23–29. [Google Scholar]

- Brynjolfsson, E.; Milgrom, P. Complementarity in Organizations. In Handbook of Organizational Economics; Gibbons, R., Roberts, J., Eds.; Princeton University Press: Princeton, 2012; pp. 11–55. [Google Scholar]

- Chesbrough, H.; Rosenbloom, R. S. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spinoff companies. Industrial and Corporate Change 2002, 11(3), 529–555. [Google Scholar] [CrossRef]

- De Reuver, M.; Bouwman, H.; MacInnes, I. Business Models Dynamics for Start-ups and Innovating e-businesses. International Journal of Electronic Business 2009, 7(3), 269–286. [Google Scholar] [CrossRef]

- Demil, B.; Lecocq, X. Business model evolution: In search of dynamic consistency. Long Range Planning 2010, 43(2–3), 227–246. [Google Scholar] [CrossRef]

- Donaldson, L. Strategy and structural adjustment to regain fit and performance: In defence of contingency theory. Journal of Management Studies 1987, 24(1), 1–24. [Google Scholar] [CrossRef]

- Doz, Y.; Hamel, G. Alliance Advantage; Harvard Business Press: Boston, MA, 1998. [Google Scholar]

- Ennen, E.; Richter, A. The whole is more than the sum of its parts—Or is it? A review of the empirical literature on complementarities in organizations. Journal of Management 2010, 36(1), 207–233. [Google Scholar] [CrossRef]

- Ferreira, F. N. H.; Proença, J. F.; Spencer, R.; Cova, B. The transition from products to solutions: External business model fit and dynamics. Industrial Marketing Management 2013, 42(7), 1093–1101. [Google Scholar] [CrossRef]

- Foss, N. J.; Saebi, T. Fifteen Years of Research on Business Model Innovation: How Far Have We Come, and Where Should We Go? Journal of Management 2017, 43(1), 200–227. [Google Scholar] [CrossRef]

- Foss, N. J.; Saebi, T. Business models and business model innovation: Between wicked and paradigmatic problems. Long Range Planning 2018, 21(1), 9–21. [Google Scholar] [CrossRef]

- Fuentelsaz, L.; Gómez, J.; Polo, Y. Followers’ entry timing: Evidence from the Spanish banking sector after deregulation. Strategic Management Journal 2002, 23, 245–264. [Google Scholar] [CrossRef]

- George, G.; Bock, A. J. The business model practice and its implications for entrepreneurship research. Entrepreneurial Theory and Practice 2011, 35, 81–111. [Google Scholar] [CrossRef]

- George, P. A. What Can Economics Offer Strategy? A Review of: D. Besanko, D. Dranove and M. Shanley Economics of Strategy. International Journal of the Economics of Business 1997, 4(2), 215–227. [Google Scholar]

- Ghaziani, A.; Ventresca, M. J. Keyywords and Cultural Change: Frame Analysis of Business Model Public Talk, 1975–2000. Sociol Forum 2005, 20, 523–559. [Google Scholar] [CrossRef]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strategic Management Journal 1999, 20(5), 397–420. [Google Scholar] [CrossRef]

- Gulati, R.; Nohria, N.; Zaheer, A. Strategic networks. Strategic Management Journal 2000, 21(3), 203–215. [Google Scholar] [CrossRef]

- Hawawini, G.; Subramanian, V.; Verdin, P. Is performance driven by industry- or firm-specific factors? A new look at the evidence. Journal of Strategic Management 2003, 24(1), 1–16. [Google Scholar] [CrossRef]

- Katz, M. L.; Shapiro, C. Network Externalities, Competition, and Compatibility. The American Economic Review 1985, 75, 424–440. [Google Scholar]

- Kulins, C.; Leonardy, H.; Weber, C. A configurational approach in business model design. Journal of Business Research 2016, 69(4), 1437–1441. [Google Scholar] [CrossRef]

- Li, Y.; Liu, H.; Lim, E.; Goh, J.; Yang, F.; Lee, M. Customer’s reaction to cross-channel integration in omnichannel retailing: The mediating roles of retailer uncertainty, identity attractiveness, and switching costs. Decision Support Systems 2018, 109, 50–60. [Google Scholar] [CrossRef]

- Lucking-Reiley, D.; Spulber, D. Business-to-Business Electronic Commerce. Journal of Economic Perspectives 2001, 15(1), 55–68. [Google Scholar] [CrossRef]

- Massa, L.; Tucci, C. L.; Afuah, A. A critical assessment of business model research. Academy of Management Annals 2017, 11, 73–104. [Google Scholar] [CrossRef]

- McGahan, A. M.; Porter, M. What do we know about variance in accounting profitability. Management Science 2002, 48(7), 821–953. [Google Scholar] [CrossRef]

- Miles, R. E.; Snow, C. C. Organization Structure, Strategy, and Process; McGraw-Hill: New York, 1978. [Google Scholar]

- Miles, R. E.; Snow, C. C. Organizations: New concept for new forms. California Management Review 1986, 28, 62–73. [Google Scholar] [CrossRef]

- Milgrom, P.; Roberts, J. Complementarities and Fit: Strategy, Structure and Organizational Change in Manufacturing. Journal of Accounting and Economics 1995, 19, 179–208. [Google Scholar] [CrossRef]

- Miller, D. Environmental fit versus internal fit. Organizational Science 1992, 3(2), 159–178. [Google Scholar] [CrossRef]

- Montgomery, D. B.; Lieberman, M. L. First Movers Advantages. Strategic Management Journal 1988, 9(1), 41–58. [Google Scholar]

- Morris, M.; Schindehutte, M.; Allen, J. The entrepreneur’s business model: Toward a unified perspective. Journal of Business Research 2005, 58(6), 726–735. [Google Scholar] [CrossRef]

- Nelson, R.; Dosi, G.; Helfat, C.; Pyka, A.; Saviotti, P.; Lee, K.; Dopfer, K.; Malerba, F.; Winter, S. Modern Evolutionary Economics: An Overview; Cambridge University Press: Cambridge, 2018. [Google Scholar]

- Ovezmyradov, B.; Kurata, H. Effects of customer response to fashion product stockout on holding costs, order sizes, and profitability in omnichannel retailing. International transactions in operational Research 2017, 26, 200–222. [Google Scholar] [CrossRef]

- Parayre, R. The strategic implications of sunk costs: A behavioral perspective. Journal of Economic Behavior & Organization 1995, 28(3), 417–442. [Google Scholar]

- Parker, G.; van Alstyne, M. W.; Choudary, S. P. Platform Revolution: How Networked Markets Are Transforming the Economy? And How to Make Them Work for You; W. W. Norton & Company, 2016. [Google Scholar]

- Pateli, A. G.; Giaglis, G. M. Technology innovation-induced business model change: A contingency approach. Journal of Organisational Change Management 2005, 18(2), 167–183. [Google Scholar] [CrossRef]

- Piotrowicz, W.; Cuthbertson, R. Introduction to the Special Issue Information Technology in Retail: Toward Omnichannel Retailing. International Journal of Electronic Commerce 2014, 18(4), 5–16. [Google Scholar] [CrossRef]

- Porter, M. E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, 1985. [Google Scholar]

- Ricciardi, F.; Zardini, A.; Rossignoli, C. Organisational dynamism and adaptive business model innovation: The triple paradox configuration. Journal of Business Research 2016, 69(11), 5487–5493. [Google Scholar] [CrossRef]

- Rigby, D. The Future of Shopping. Harvard Business Review 2011, 89, 65–76. [Google Scholar]

- Ritter, T.; Letti, C. The wider implications of business-model research. Long Range Planning 2018, 51(1), 1–8. [Google Scholar] [CrossRef]

- Rumelt, R. How much does industry matter? Strategic Management Journal 1991, 12, 167–185. [Google Scholar] [CrossRef]

- Sabatier, V.; Craig-Kennard, A.; Mangematin, V. When technological dis-continuities and disruptive business models challenge dominant industry logics: Insights from the drugs industry. Technological Forecasting and Social Change 2012, 79(5), 946–962. [Google Scholar] [CrossRef]

- Schumpeter, J. A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Harvard University Press: Cambridge, MA, 1934; Reprint 1996. [Google Scholar]

- Shapiro, C.; Varian, H. R. Information Rules: A Strategic Guide to the Network Economy; Harvard Business School Press: Boston, MA, 1999. [Google Scholar]

- Simon, H. A. El Comportamiento Administrativo; Editorial Aguilar, 1962. [Google Scholar]

- Simon, H. A. Las Ciencias de Lo Artificial, Barcelona, La Nueva Ciencia de La Decisión Gerencial; El Ateneo Editorial, 1973. [Google Scholar]

- Sohl, T.; Vroom, G.; Fitza, M. How much does business model for firm performance? A variance decomposition analysis. Academy of Management 2017, 6(1). [Google Scholar] [CrossRef]

- Teece, D. J. Business models, business strategy and innovation. Long Range Planning 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Verhoef, P. C.; Kannan, P. K.; Inman, J. J. From multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. Journal of Retailing 2015, 91(2), 174–181. [Google Scholar] [CrossRef]

- Wei, Z.; Yang, D.; Sun, B.; Gu, M. The fit between technological innovation and business model design for firm growth: Evidence from China. R&D Management 2014, 44(3), 288–305. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strategic Management Journal 1984, 5(2), 171–180. [Google Scholar] [CrossRef]

- Williamson, O. E. Markets and Hierarchies: Analysis and Antitrust Implications: A Study in Economics of Internal Organization; Free Press, 1975. [Google Scholar]

- Wirtz, B. W.; Schilke, O.; Ullrich, S. Strategic Development of Business Models: Implications of the Web 2.0 for Creating Value on the Internet. Long Range Planning 2010, 43(2/3), 272–290. [Google Scholar] [CrossRef]

- Writz, B. W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business Models: Origin, Development and Future Research Perspectives. Long Range Planning 2016, 49(1), 36–54. [Google Scholar]

- Zott, C.; Amit, R. Measuring the Performance Implications of Business Model Design: Evidence from Emerging Growth Public Firms; INSEAD, 2002; Volume 18. [Google Scholar]

- Zott, C.; Amit, R. Business Model Design and the performance of entrepreneurial firms. Organization Science 2007, 18(2), 181–199. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business Model Design: An Activity System Perspective. Long Range Planning 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R.; Massa, L. The business model: Recent developments and future research. Journal of Management 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

Figure 1.

Business model themes (BMTs). Source: Amit and Zott, 2001.

Figure 1.

Business model themes (BMTs). Source: Amit and Zott, 2001.

Figure 2.

Theoretical anchoring of sources of value creation in e-commerce. Source: Amit and Zott (2001).

Figure 2.

Theoretical anchoring of sources of value creation in e-commerce. Source: Amit and Zott (2001).

Figure 3.

Relationships between business model themes (BMTs). Source: Amit and Zott (2001).

Figure 3.

Relationships between business model themes (BMTs). Source: Amit and Zott (2001).

Figure 4.

Testing the interactions between product market strategy (PMS) and business model themes (BMTs). Source: Produced by the authors.

Figure 4.

Testing the interactions between product market strategy (PMS) and business model themes (BMTs). Source: Produced by the authors.

Figure 5.

Product market strategy (PMS), business model (BM) and market strategy MS at a specific moment and over time. Source: Produced by the authors.

Figure 5.

Product market strategy (PMS), business model (BM) and market strategy MS at a specific moment and over time. Source: Produced by the authors.

© 2021 Copyright by the authors. Licensed as an open access article using a CC BY 4.0 license.