J_Bus_Account_Financ_Perspect 2021, 3(1), 5; doi:10.35995/jbafp3010005

Cultural Specifics and the Momentum Effect on the Bulgarian Stock Exchange

Department of Finance and Accounting, Faculty of Economics and Business Administration, Sofia University “St. Kliment Ohridski”, 125 Tsarigradsko Shose Blvd., Block 3, 1113 Sofia, Bulgaria; bozhidar.nedev@feb.uni-sofia.bg or bozhidar.nedev@gmail.com

How to cite: Bozhidar Nedev. Cultural Specifics and the Momentum Effect on the Bulgarian Stock Exchange. J. Bus. Account. Financ. Perspect., 2021, 3(1): 5; doi:10.35995/jbafp3010005.

Received: 17 January 2021 / Accepted: 23 February 2021 / Published: 9 March 2021

Abstract

:This article analyses the relationship between the documented momentum effect on the Bulgarian Stock Exchange and the cultural characteristics of Bulgarian society on the basis of the 6-Dimensions Culture Model by Hofstede. Derived are possible behavioural biases, that could cause investors to underreact to firm-specific information, resulting in short-term return predictability. Outlined are implications for the relation between the rising of momentum effect and low individualism index, as identified on the Bulgarian Stock Exchange (BSE).

JEL Classification:

G40; G41; G11; G121. Introduction

One of the most pronounced topics for numerous scientists, working in the field of behavioural and even traditional finance, for the last 25 years is cross-sectional momentum effect. This market anomaly has been primarily identified by Jegadeesh and Titman (1993), who document the presence of short-term return predictability, based on the stock performance over the previous 3 to 12 months. Thus, holding a long position in the past winner stocks and taking a short position on the past losers for the subsequent 3 to 12 months turns out to be a profitable investment strategy on the U.S. stock markets (NYSE and AMEX) in every five-year period between 1965 and 2009, except in the last one, due to the negative impact of the Global Financial Crisis (Jegadeesh and Titman, 2011; Bird et al., 2017). Momentum effect is qualified by Eugene Fama as one of the most challenging evidences towards the Efficient Market Hypothesis. Fama expresses his hope that this market anomaly will eventually disappear (Asness, 2016). Even though a considerable amount of literature on the momentum effect in developed and emerging markets is already available, still the necessity to further develop and deepen this research strand onto frontier markets like the Bulgarian Stock Exchange (BSE) is evidenced by the relative lack of research emphasis on such markets.

Our goal is to investigate the common stock equity market on the BSE and to find out whether the identified momentum effect in the pre-crisis period (2004–2007) can be explained through the lens of the 6 Dimensions Model of Culture by Geert Hofstede. What is more, because of the relative lack of behavioural studies on the BSE, the implications of the cultural model would contribute to examination of the specific behavioural drivers, underlying the existence of momentum effect in Bulgaria. Thus, we will also reveal the impact of the individualism index on the availability of the momentum effect on the BSE in comparison to the behavioural literature in this area.

We achieve our goal by applying the results of the 6-D Model, provided by Hofstede Insights (2018), to the empirical findings of Nedev and Bogdanova (2018). As stated by the latter authors, momentum effect arises on the BSE due to underreaction by investors to incoming firm-specific information. According to this behavioural model, stock prices are slow to incorporate newly available data, which results in deviations from their corresponding fundamental values. This is why short-term return predictability arises on the Bulgarian exchange market. However, once new information is fully incorporated into stock prices in the long-run, there is no further predictability in stock returns.

Our research is motivated by the observed and broadly documented persistence of momentum effect on international stock markets1. A constantly growing body of literature is engaged in identifying possible sources of momentum profits. As stated by Jegadeesh and Titman (2001), momentum effect is unlikely to be explained within a traditional risk-based framework. This is why researchers mainly focus on behavioural explanation models on this phenomenon. Although these models do not unambiguously explain the underlying drivers of momentum, they provide a profound understanding of the phenomenon, compared to traditional risk-based models. However, behavioural models differ as to whether momentum effect arises due to underreaction or delayed overreaction to firm-specific information (Jegadeesh and Titman, 2011).

A major motivation for our study is provided by Chui et al. (2010), who relate the rise of momentum effect to cross-country cultural differences in the behaviour of investors on national stock markets. Thus, according to Chui et al. (2010), individualism is likely to be correlated with overconfidence and self-attribution bias, that in turn, underlie the presence of momentum effect due to the delayed overreaction hypothesis (Barberis et al., 1998; Daniel et al., 1998). So, there should be a positive relationship between momentum profits and individualism index by Geert Hofstede. Thus, this paper tries to investigate, if this correlation applies to momentum effect on the Bulgarian Stock Exchange as well.

According to Nedev and Bogdanova (2017), momentum is a profitable trading strategy on the BSE exclusively in the pre-crisis period between 2004 and 2007, whereafter it ceased to exist. As already stated above, underreaction to firm-specific information is the major behavioural source, underlying momentum in Bulgaria (Nedev and Bogdanova, 2018). Thus, our major findings indicate that low levels of collectivism like these observed in the Bulgarian society do not hamper the presence of the market anomaly on the BSE and its profitability, as can be seen in Nedev and Bogdanova (2017). In addition, applying the 6-D model of culture by Geert Hofstede to the documented presence of momentum effect on the BSE, we find that the high level of pessimism in Bulgarian society could explain positive momentum profits. Pessimism underlies the principle of loss aversion and the disposition effect, which according to Grinblatt and Han (2005) could lead to underreaction.

Thus, the main contribution of this paper to existing behavioural literature is by investigating the relation between the presence of momentum effect on a frontier market and the country-specific cultural characteristics of society. We come to the conclusion, that there could possibly be a relation between the observed low individualism index in Bulgaria and the rise of momentum effect on the Bulgarian Stock Exchange due to the underreaction of investors to firm-specific information. Thus, our major contribution in the relevant behavioural literature refers to the positive relationship between collectivism in society and underreaction of investors on stocks markets, which could lead to momentum profits, in addition to the conclusion of Chui et al. (2010), that has been previously discussed.

2. Literature Review

Kenourgios and Samitas (2009) assume that momentum trading strategy is the most appropriate for the realization of abnormal profits on the emerging stock markets in Bulgaria, Romania, Croatia and Turkey. The sample of the authors includes the mean of the profits of four representative equity indexes as one common portfolio between 2000 and 2007. According to the findings of Kenourgios and Samitas (2009), the emerging Balkan markets overreact to occurrences and changes in the developed ones (US, UK, Germany and Greece).

Although most of the behavioural models assume that momentum effect is driven by serial correlations of individual stock returns, they differ as to whether underreaction or delayed overreaction underlie the serial correlation (Jegadeesh and Titman, 2011). Behavioural models refer to different cognitive and emotional biases, that influence the decision-making process of investors and cause momentum. At first, we present a summary on those models that underlie the hypothesis of underreaction.

As stated by George and Hwang (2004), short-term momentum and long horizon reversals are largely separate phenomena. The researchers present a new momentum trading strategy, based on the nearness to the 52-week high, that is used as a predictor of future returns in comparison to past performance over the previous up to 12 months, as in the traditional paper of Jegadeesh and Titman (1993). George and Hwang (2004) find out that the 52-week high turns out to be a better approach, since it provides higher predictive power and is never followed by long-run return reversals. Short-term underreaction to firm-specific information is associated with the prevalence of anchoring bias. Thus, when evaluating the potential impact of news, investors use the 52-week high as a reference point (anchor). Influenced by this anchoring bias, traders avoid buying (selling) a security, if good (bad) news has pushed its price near or over (under) its 52-week high (low). In the short-term horizon, this behaviour would result in return continuation: further upward (downward) price movement or momentum effect. However, in the long-term horizon good (bad) news would eventually prevail. Yet, Grinblatt and Han (2005) introduce an alternative explanation of underreaction, based on the disposition effect. Since loss-averse investors tend to hold loser stocks too long and sell winner ones too early as compared to the rational economic theory, this behaviour causes a deviation between the fundamental value and the market price, thus giving rise to return predictability and momentum effect.

Second, we turn to the behavioural hypothesis of delayed overreaction. According to De Long et al. (1990), positive feedback trading strategies, followed by investors, give rise to deviations of stock prices from their fundamental values and generate increase market volatility. This in turn causes short-term return predictability or momentum effect. In the long run, however, momentum profits are followed by losses due to reversal of market prices to their fundamental values. Daniel et al. (1998) refer to self-attribution bias as an incentive for informed investors to exhibit delayed overreaction to winner-stocks. When observing positive signals about a set of stocks, investors attribute the further profitable performance of ex-post winners to their own selection skills. On the other hand, the bad performance of ex-post losers is attributed to bad luck. Therefore, overconfident investors excessively invest in winners, pushing their prices above the fundamental values, which ultimately leads to a reversion and losses in the long run.

Finally, the third group of behavioural models explains how investors might form beliefs and make decisions, that result in both underreaction and overreaction. According to Barberis et al. (1998), conservatism bias could make investors underweight new firm-specific information and overweight previous one. As a result, stock prices would slowly incorporate new information (underreaction). Nevertheless, representativeness bias in combination with conservatism bias could cause investors to overreact to news. Thus, market prices would exceed their fundamental values, resulting in return reversals in the long run. Lastly, Hong and Stein (1999) do not refer to any behavioural biases but introduce a model, consisting of two different groups of investors. Each group is provided with completely different subset of the publicly available information. On the one hand, informed investors obtain signals about future stock price fundamentals, whereas technical or momentum investors rely only on a limited amount of historical price datasets. Informed investors underreact to information, causing technical traders to arbitrage out this underreaction. Eventually, this leads to overreaction because of the profitability opportunities, identified by the latter group.

Finally, Cakici et al. (2013) find out that momentum effect is not a profitable trading strategy in the group of five East-European stock markets—Russia, Turkey, Czech Republic, Poland and Hungary. As a possible explanation to this evidence, the authors refer to the paper of Chui et al. (2010) and the individualism index by Hofstede. According to Cakici et al. (2013), the low level of individualism (37 points), innate to Turkish investors, could explain the lack of return predictability.

3. Methodology

In this section, we will briefly present the research mythology that has been used to document the availability of momentum effect on the BSE and has identified the underreaction hypothesis as the behavioural source of return predictability. Nedev and Bogdanova (2017) replicate the methodology, employed by Alphonse and Nguyen (2013).

Concerning data preparation, Nedev and Bogdanova (2017) use weekly returns for 69 public companies, traded on the Bulgarian Stock Exchange in the period between 1-January-2004 and 31-July-2017. The data are sampled on weekly basis—closing prices as of Monday. The major source for data collection is the Bulgarian financial internet-site http://www.infostock.bg/. It is worth mentioning that the Bulgarian Stock Exchange, nor anyone else, does not keep an official register on historical prices and volumes, which imposes some challenges to the analysis2. Next, some historical price observations are missing, either due to a lack of official historical records, or due to low liquidity on the market. This is why spline interpolation3 is applied to fill the missing values, that account for less than 50% of all weekly closing prices for a stock in the investigated sample period. Another issue in data preparation is the occurrence of negative interpolated prices. Thus, Nedev and Bogdanova (2017) exclude all such sub-periods within the whole sample period. In addition, some of the weekly data had to be adjusted for stock splits. Dividend payments have not been accounted for, because these were only occasionally distributed, and by few companies. What is more, according to (Kasabov, 2017), investors on the Bulgarian Stock Exchange are more interested in companies, that do not pay dividends because of taxation, although the tax rate in amount of 5% on income is relatively low. This is why public companies in Bulgaria also do not strive to follow an active dividend policy. Another possible reason is the outbreak of the Global Financial Crisis of 2008–2009 and the need for liquidity.

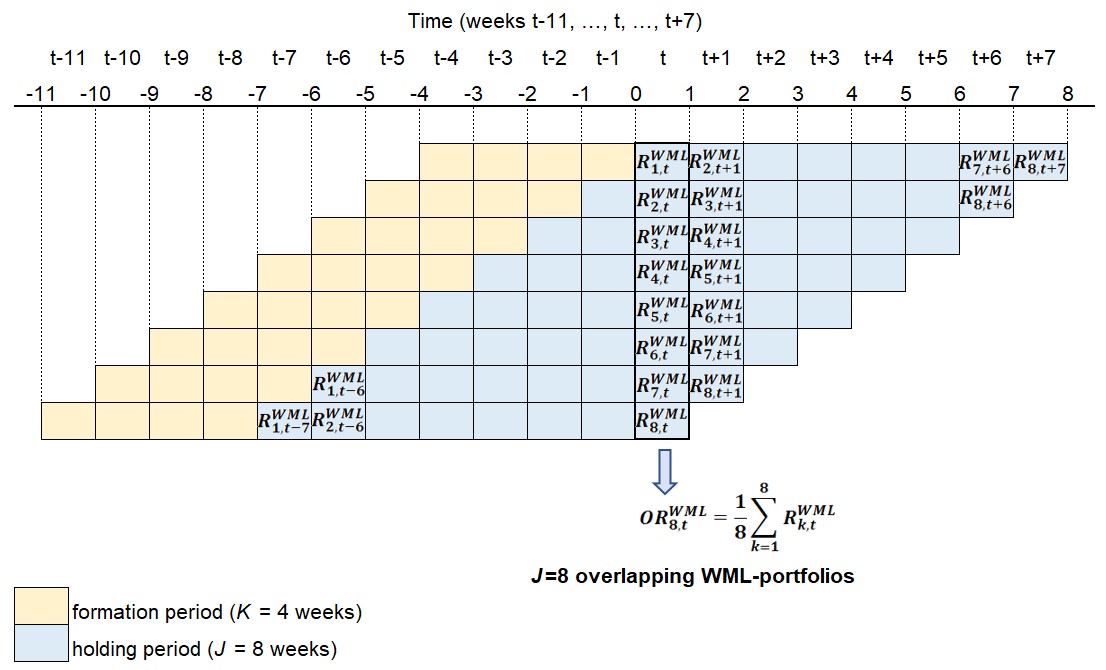

As already stated, Nedev and Bogdanova (2017) employ the methodology, used by Alphonse and Nguyen (2013) for the Vietnamese Stock Exchange. In week t, Nedev and Bogdanova (2017) divide stocks into quintiles according to their average past returns over the previous K weeks (K = 1, 2, 4, 8, 13, 26, 39 and 52 weeks—formation period). The holding period J amounts to 1, 2, 4, 8, 13, 26, 39 and 52 weeks. Thus, the authors examine 64 different momentum strategies on the BSE. The raw profits for Winner-minus-loser portfolio (WML) portfolios in a given week t are denoted by: (k = 1, …, J). As common in literature overlapping portfolios are used to reinforce statistical tests. The profits of all J overlapping portfolios in a given calendar week t are equally averaged (Figure 1 represents the overlapping principle, used for the WML-portfolio K = 4 weeks and J = 8 weeks):

Afterwards, Nedev and Bogdanova (2017) compute the average of the overlapping profit on the WML portfolio as a metric to test the momentum on the BSE. For the whole analysed sample between 2004 and July 2017, momentum profits arise exclusively in the pre-crisis period (2004–2007), providing a weekly gain of up to 1.46% for the WML portfolio (K = 1; J = 1) (t-stat. = 2.6522). Because of the low liquidity on the BSE, the strategy (K = 1; J = 1) is considered as inappropriate for the research purposes. That is why, the WML portfolio (K = 26; J = 8), that earns the second-highest profit of 1.34% per week (t-stat. = 4.2987), is taken into consideration.

Next, Nedev and Bogdanova (2018) study the WML portfolio (K = 26; J = 8) raw profits for the post-holding periods on a time span from nine weeks to one year . This time series corresponds to the weekly raw profits of the WML portfolio formed on the basis of average stock performance over previous weeks and being held for weeks. The researchers analyze the changes in the series as j increases, so as to conclude on underreaction or overreaction. In addition, to reinforce the obtained results, Nedev and Bogdanova (2018) further apply the CAPM and the Fama–French model.

4. Research Results

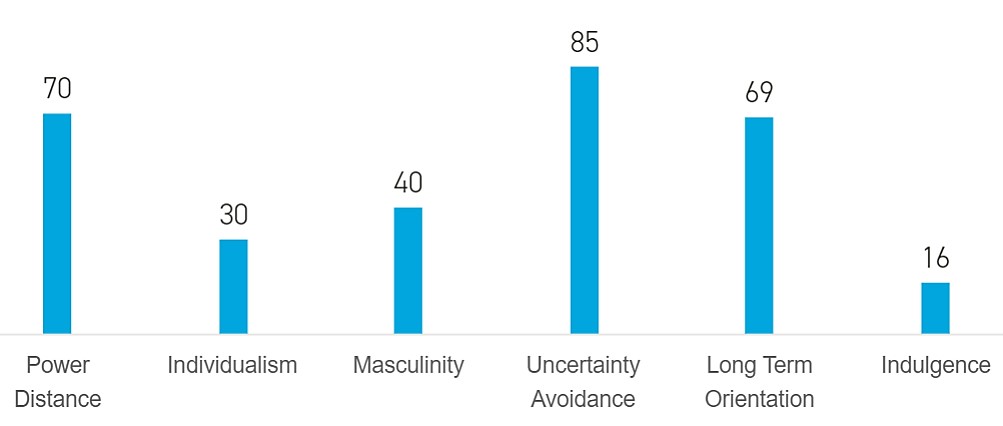

As already stated, Nedev and Bogdanova (2018) find out that in the pre-crisis period, abnormal WML portfolio profits on the BSE are followed by normal returns in the long run. This indicates that investors on the BSE have underreacted to firm-specific information in the pre-crisis period. However, there are two alternative behavioural explanations for the underreaction hypothesis—loss aversion (Grinblatt and Han, 2005) or anchoring bias (George and Hwang, 2004). We argue that the application of the 6-D Model of Culture by Hofstede for the Bulgarian society4 to the empirical results of Nedev and Bogdanova (2018) could reveal the underlying behavioural biases, which have caused short-run return predictability on the BSE between 2004 and 2007. Figure 2 presents the milestones for the Bulgarian culture through the lens of the 6-D Model. It is worth mentioning that the presented cultural characteristics are reflected in the Bulgarian society as a whole, as differences between individuals may be considerable.

The first dimension is power distance. Bulgaria scores relatively high on this dimension (70 points), which indicates that centralization and strong hierarchical order dominate among the society. On a corporate level, subordinates expect to be told what to do from the autocratical boss. This is why hierarchy is perceived as an inherited quality. Second, the Bulgarian society is built on the principle of collectivism. The individualism index is relatively low—30 points. This implies that individuals exhibit long-term commitment to the member group, they belong to, i.e., family, relatives or friends. Taking responsibility for the member group is fostered by society. For instance, hiring and promotion decisions are taken based on consideration of member group. The third dimension is masculinity, where Bulgaria is considered as relatively feminine (40 points). Equality, solidarity and negotiations by resolving conflicts are favoured. People value well-being. Next, Bulgaria scores relatively high on the uncertainty avoidance index (85 points), which means, that people exhibit an emotional need for rules, even if regulations are unlikely to be effective. Security, precision and punctuality are favoured. Fifth, Bulgarian society is pragmatically orientated (69 points). When confronted with changing circumstances, people strive to adapt themselves to new conditions by considering situation, context and time. Propensity to save and invest is also very strong. Last, Bulgaria is among the societies that score least in the indulgence index. This indicates that Bulgarian society is extremely pessimistic. Social norms have a strong impact on personal actions (Hofstede Insights, 2018).

As can be seen from the empirical results of Nedev and Bogdanova (2017), momentum effect is present on the BSE during the pre-crisis period, as it realizes high profits on a weekly basis. Compared to the implications in the paper of Chui et al. (2010), the low individualism index, intrinsic for Bulgarian society, does not hamper the rising of short-term return predictability, based on past stock performance. It is worth mentioning, that the discussed cultural characteristics are considered by Hofstede (2011) as extremely pervasive and static over time. Chui et al. (2010) refer the rising of momentum effect to high levels of individualism, that in turn underlies the behavioural biases of overconfidence and self-attribution. According to Barberis et al. (1998) and Daniel et al. (1998), such behavioural biases could cause delayed overreaction of investors to firm-specific information, which results in short-term return predictability of traded stocks, but also in long-term return reversals. On the other hand, the documented momentum effect on the BSE is driven by underreaction in the pre-crisis period. This empirical result indicates a possible relation between the low level of individualism index by Hofstede and momentum effect, rising however due to the underreaction behavioural model.

What is more, the application of the 6-D model of culture to the results of Nedev and Bogdanova (2018) could contribute to the explanation of the underlying behavioural drivers, that have caused underreaction to firm-specific information. As stated above, there are two alternative models—loss aversion and disposition effect (Grinblatt and Han, 2005) and anchoring bias (George and Hwang, 2004). According to the low indulgence index, Bulgarian society is considered as highly pessimistic. In turn, pessimism underlies disposition effect and loss aversion principle, as can be seen in Ceschi et al. (2014), Chapman and Polkovnichenko (2009) and De Palma (2008). The researchers argue that pessimism as a way of considering losses, when investing, is the basis of the occurrence of regret aversion, sunk-cost fallacy, loss aversion and disposition effect. Thus, generating losses is perceived by humans as much more painful than the gratification from realizing an equal amount of profits from investing.

Thus, based on the 6-D culture model for Bulgaria by Hofstede, underreaction on the BSE could be explained by the behavioral model of Grinblatt and Han (2005), that refers to loss aversion and disposition bias. Therefore, we could assume that investors on the Bulgarian capital market have been driven by pessimism and restraint to hold losing investments too long in the hope, that they get back, what they lost compared to the purchase price. Simultaneously, investors tend to sell winner stocks too early, as should be expected by normative theory and econs. The incentive, causing this investor behaviour, lies in the fear, that profits would evaporate, unless securities are sold (Pompian, 2012). That is why, return trends of losing and winner stocks continue to prevail, causing short-term return predictability on exchange markets and normal returns in the long-term.

On the other hand, the alternative behavioural model of George and Hwang (2004) explains the underreaction hypothesis by the nearness of the market price of a stock to its 52-week high or low. In regard to the implications from the 6-D model, Bulgarian society is concerned with being pragmatic and taking into account current circumstances when evaluating particular actions and possible decisions. However, anchoring bias assumes adherence to previous information and beliefs and neglecting and underweighting new data for exchange markets and traded securities. As a conclusion, we could argue that momentum effect on the BSE in the pre-crisis period (2004–2007) arises due to the underreaction of investors to firm-specific information, that can be explained by the behavioural model of Grinblatt and Han (2005, p. 316), that refers to disposition effect and loss aversion principle.

5. Conclusion

As argued by Nedev and Bogdanova (2018), the underreaction of investors to firm-specific information has caused the rise of momentum effect on the BSE in the pre-crisis period (2004–2007). This implication is based on empirical evidence, that in the long-horizon momentum, profits do not reverse. The current paper applies the 6-Dimensions Model of Culture by Hofstede to the research results of Nedev and Bogdanova (2018) and finds out, that the Bulgarian society is characterized by centralization, strong hierarchy, collectivism, emotional need for regulations, restraint, pessimism, strive for consensus and well-being, pragmatic orientation and precision. Thus, we come to the conclusion, that the low level of individualism in the Bulgarian society does not hamper the rise of momentum effect. So, momentum effect could rise in a collectivistic society. The underlying behavioural reason is, however, underreaction. What is more, loss aversion and disposition effect as behavioural biases, that could explain momentum (Grinblatt and Han, 2005), are based on pessimism (a cultural quality in Bulgaria). Therefore, we conclude that underreaction is caused by loss aversion and disposition effect on the BSE. On the other hand, anchoring bias is neglected as a potential source of underreaction due to the evidence from the 6-D model, that Bulgarian society is pragmatic. Identified underreaction due to pessimism and resulting in the rise of momentum does not reoccur after the Global Financial Crisis. This observation could possibly mean that investors on the BSE have become more cautious (rational) in decision-making than in the 2004–2007 period and/or that the consequences of the crises on the Bulgarian stock market have not yet been overcome. Concerning the latter, the trading volumes on the BSE give evidence for that assumption. Lastly, the paper is characterized by some shortcomings, like the specifically chosen method for interpolation of missing values (via spline-functions), and the fact that foreign investors are also part of the BSE. That is why, employed cultural specifics for the Bulgarian society from the 6-D model by Hofstede could possibly not correspond to all investors on the BSE in the sample period.

References

- Alphonse, P.; Nguyen, T. H. Momentum Effect: Evidence from the Vietnamese Stock Market. Asian Journal of Finance & Accounting 2013, 5(2), 183–202. [Google Scholar]

- Asness, C. S. Fama on Momentum; 2016; from https://www.aqr.com/cliffs-perspective/fama-on-momentum Retrieved 31 July 2017.

- Asness, C. S.; Moskowitz, T. J.; Pedersen, L. H. Value and Momentum Everywhere. The Journal of Finance 2013, 68(3), 929–985. [Google Scholar] [CrossRef]

- Barberis, N.; Shleifer, A.; Vishny, R. A model of investor sentiment. Journal of Financial Economics 1998, 49, 307–343. [Google Scholar] [CrossRef]

- Bird, R.; Gao, X.; Yeung, D. Time-series and cross-sectional momentum strategies under alternative implementation strategies. Australian Journal of Management 2017, 42(2), 230–251. [Google Scholar] [CrossRef]

- Cakici, N.; Fabozzi, F. J.; Tan, S. Size, Value, and Momentum in Emerging Market Stock Returns. Emerging Markets Review 2013, 16, 46–65. [Google Scholar] [CrossRef]

- Ceschi, A.; Rubaltelli, E.; Sartori, R. Designing a Homo Psychologicus More Psychologicus: Empirical Results on Value Perception in Support to a New Theoretical Organizational-EconomicAgent Based Model; Springer International Publishing: Cham, Switzerland, 2014; pp. 71–78. [Google Scholar]

- Chapman, D. A.; Polkovnichenko, V. First-Order Risk Aversion, Heterogenity, and Asset Market Outcomes. The Journal of Finance 2009, 64(4), 1863–1887. [Google Scholar] [CrossRef]

- Chui, A. C. W.; Titman, S.; Wei, J. K. C. Individualism and Momentum around the World. The Journal of Finance 2010, 65(1), 361–392. [Google Scholar] [CrossRef]

- Daniel, K.; Hirshleifer, D.; Subrahmanyam, A. Investor Psychology and Security Market Under- and Overreactions. The journal of Finance 1998, 53(6), 1839–1886. [Google Scholar] [CrossRef]

- De Long, B. J.; Shleifer, A.; Summers, L. H.; Waldmann, R. J. Positive Feedback Investment Strategies and Destabilizing Rational Speculation. The Journal of Finance 1990, 45(2), 379–395. [Google Scholar] [CrossRef]

- De Palma, A.; Ben-Akiva, M.; Brownstone, D.; Holt, C.; Magnac, T.; McFadden, D.; Moffatt, P.; Picard, N.; Train, K.; Wakker, P.; Walker, J. Risk, uncertainty and discrete choice models. Marketing Letters 2008, 19(3–4), 269–285. [Google Scholar] [CrossRef]

- George, T. J.; Hwang, C.-Y. The 52-Week High and Momentum Investing. The Journal of Finance 2004, 59(5), 2145–2176. [Google Scholar] [CrossRef]

- Grinblatt, M.; Han, B. Prospect theory,mental accounting, and momentum. Journal of Financial Economics 2005, 78, 311–339. [Google Scholar] [CrossRef]

- Grinblatt, M.; Moskowitz, T. J. Predicting stock price movements from past returns: The role of consistency and tax-loss selling. Journal of Financial Economics 2004, 71, 541–579. [Google Scholar] [CrossRef]

- Hofstede Insights. Hofstede Insights; 2018; from https://www.hofstede-insights.com/country-comparison/bulgaria,turkey/ Retrieved 17 February 2018.

- Hofstede, G. Dimensionalizing Cultures: The Hofstede Model in Context. Online Readings in Psychology and Cultur 2011, 2(1), 1–26. [Google Scholar] [CrossRef]

- Holton, G. A. Value-at-Risk Theory and Practice, 2nd ed.; Belmont, 2014; www.value-at-risk.net.

- Hong, H.; Stein, J. A unified theory of underreaction, momentum trading and overreaction in asset markets. The Journal of Finance 1999, 54, 2143–2184. [Google Scholar] [CrossRef]

- Jegadeesh, N.; Titman, S. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance 1993, 48(1), 65–91. [Google Scholar] [CrossRef]

- Jegadeesh, N.; Titman, S. Profitability of Momentum Strategies: An Evaluation of Alternative Explanations. The Journal of Finance 2001, 56(2), 699–720. [Google Scholar] [CrossRef]

- Jegadeesh, N.; Titman, S. Momentum. Annual Review of Financial Economics 2011, 3, 493–509. [Google Scholar] [CrossRef]

- Kasabov, M. Vzaimodeystvie mezhdu tsenite na aktsiite i parichnite dividenti na izbrani balgarski kompanii. Ikonomicheski i Sotsialni Alternativi 2017, 2017(4), 43–60. [Google Scholar]

- Kenourgios, D.; Samitas, A. Overreaction Hypothesis in Emerging Balkan Stock Markets. In Emerging Markets: Performance, Analysis and Innovations; Gregoriou, G. G., Ed.; Chapman Hall: London, 2009; pp. 185–202. [Google Scholar]

- Menkhoff, L.; Sarno, L.; Schmeling, M.; Schrimpf, A. Carry Trades and Global Foreign Exchange Volatility. The Journal of Finance 2012, 67(2), 681–718. [Google Scholar] [CrossRef]

- Moskowitz, T. J.; Grinblatt, M. Do Industries Explain Momentum? The Journal of Finance 1999, 54(4), 1249–1290. [Google Scholar] [CrossRef]

- Nedev, B.; Bogdanova, B. A study on the momentum effect for the Bulgarian Stock Exchange: some practical issues of applied importance. Vanguard Scientific Instruments in Management, 2017. [Google Scholar]

- Nedev, B.; Bogdanova, B. Long Horizon Returns of Momentum Portfolios on the Bulgarian Stock Exchange: Behavioural Explanations; “St. Kl. Ohridski”—FEBA; Sofia University: Sofia, 2018; pp. 110–119. [Google Scholar]

- Pompian, M. M. Behavioral Finance and Wealth Management: How to Build Investment Strategies That Account for Investor Biases, 2nd ed.; John Wiley & Sons Inc.: Hoboken, 2012. [Google Scholar]

- Rouwenhorst, G. K. International Momentum Strategies. The Journal of Finance 1998, 53(1), 267–284. [Google Scholar] [CrossRef]

- Rouwenhorst, G. K. Local Return Factors and Turnover in Emerging Stock Markets. The Journal of Finance 1999, 54(4), 1439–1464. [Google Scholar] [CrossRef]

| 1 | The ross-sectional momentum effect has been identified in US equities (Jegadeesh and Titman, 1993), in US industries (Moskowitz and Grinblatt, 1999), in developed European stocks markets (Rouwenhorst, 1998), in international emerging stock markets (Rouwenhorst, 1999; Cakici et al., 2013), in equity indexes, bond markets, currencies, futures markets and commodity markets (Asness et al., 2013; Menkhoff et al., 2012). |

| 2 | This is why all 69 investigated public companies on the BSE are being traded as of the 31st of July 2017. Historical datasets for companies, that have been delisted, consist mainly of a lot of missing values and are thus not worth analysing. |

| 3 | |

| 4 | The 6 Dimensions for Bulgaria are freely available on the website of Hofstede Insights: https://www.hofstede-insights.com/. The company offers consultancy services for institutions, when they intend to grow their business internationally. Hofstede Insights is licensed by Prof. Geert Hofstede for practical application of his theoretical models to the real business area. |

Figure 1.

Overlapping principle as in the case of WML portfolio (K = 4; J = 8).

Figure 2.

6 Dimensions Model of Culture for Bulgaria (Hofstede Insights, 2018).

Figure 2.

6 Dimensions Model of Culture for Bulgaria (Hofstede Insights, 2018).

© 2021 Copyright by the authors. Licensed as an open access article using a CC BY 4.0 license.